Retired a piece of machinery that was purchased on – Retiring a piece of machinery that was purchased on a specific date is a crucial decision that requires careful consideration. This article delves into the various factors influencing machinery retirement, including the purchase date, financial implications, environmental impact, and legal considerations.

By understanding these aspects, businesses can make informed decisions that optimize their operations and minimize the impact of machinery retirement.

The purchase date of machinery plays a significant role in determining its retirement timeline. Factors such as depreciation schedules, maintenance costs, and technological advancements influence the decision to retire machinery at a particular time. Understanding the relationship between purchase date and retirement can help businesses plan effectively for machinery replacement and minimize downtime.

Machinery Retirement

Machinery retirement is the process of removing a piece of machinery from active use. This decision is typically made when the machinery is no longer cost-effective to operate or maintain, or when it has reached the end of its useful life.

Reasons for Retiring Machinery

- Obsolescence:Machinery may become obsolete due to technological advancements or changes in production processes.

- Wear and tear:Machinery components can wear out over time, making it inefficient or unsafe to operate.

- High maintenance costs:The cost of maintaining machinery can become excessive, making it more economical to replace it.

- Safety concerns:Machinery may become unsafe to operate due to age, wear, or technological limitations.

- Environmental regulations:New environmental regulations may make it necessary to retire machinery that does not meet current standards.

Benefits of Retiring Machinery

- Reduced operating costs:Retiring obsolete or inefficient machinery can save money on energy, maintenance, and repairs.

- Improved safety:Removing unsafe machinery from operation reduces the risk of accidents and injuries.

- Increased productivity:Replacing old machinery with new, more efficient models can improve production efficiency.

- Environmental benefits:Retiring machinery that does not meet environmental standards can reduce pollution and waste.

Purchased Date Analysis

The purchase date of machinery is an important factor to consider when planning for its retirement. The age of the machinery can affect its operating costs, maintenance requirements, and resale value.

How Purchase Date Affects Retirement

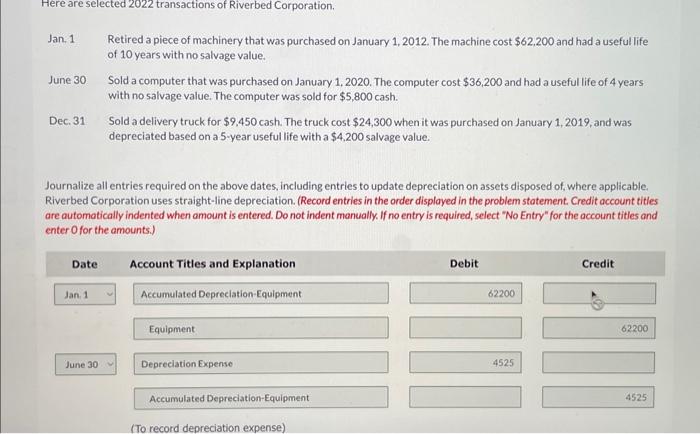

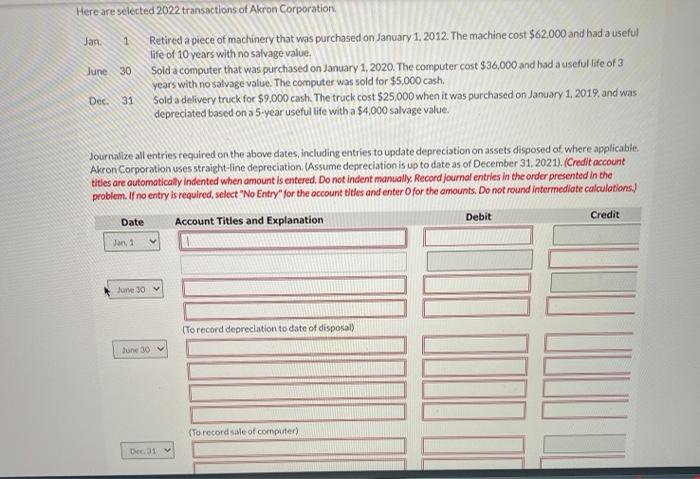

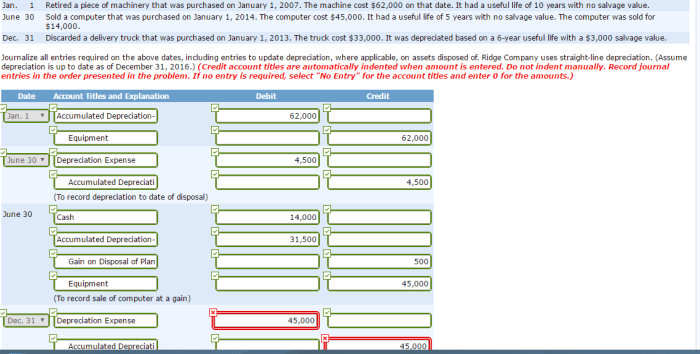

- Depreciation:Machinery is typically depreciated over its useful life. The purchase date determines the starting point for depreciation calculations.

- Maintenance costs:Older machinery is more likely to require frequent and expensive maintenance.

- Resale value:The resale value of machinery decreases as it ages.

- Technological advancements:Machinery that is purchased earlier may not have the same technological capabilities as newer models.

Importance of Considering Purchase Date

Considering the purchase date when planning for machinery retirement allows businesses to:

- Plan for replacement costs:Businesses can estimate the cost of replacing machinery based on its age and depreciation schedule.

- Schedule maintenance:Businesses can plan for increased maintenance costs as machinery ages.

- Maximize resale value:Businesses can sell machinery before its value depreciates significantly.

- Stay competitive:Businesses can ensure that they have the latest technology by replacing older machinery.

Financial Implications

Retiring machinery can have significant financial implications for businesses. The costs associated with machinery retirement include:

Costs of Machinery Retirement

- Disposal costs:Machinery can be disposed of through various methods, such as scrapping, recycling, or selling it as scrap.

- Removal costs:Machinery must be removed from its operating location and transported to a disposal facility.

- Lost productivity:Retiring machinery can result in lost production time while the new machinery is being installed and commissioned.

- Environmental cleanup costs:Machinery may contain hazardous materials that require special disposal procedures.

Strategies for Minimizing Financial Impact

- Proper planning:Planning for machinery retirement in advance can help businesses minimize costs.

- Consider resale:Selling retired machinery as scrap or used equipment can generate revenue.

- Negotiate disposal contracts:Businesses can negotiate with disposal companies to reduce disposal costs.

- Tax deductions:Businesses may be eligible for tax deductions for the cost of retiring machinery.

Environmental Impact

Retiring machinery can have both positive and negative environmental impacts.

Positive Impacts

- Reduced pollution:Retiring machinery that does not meet environmental standards can reduce air and water pollution.

- Reduced waste:Recycling or disposing of retired machinery properly prevents it from ending up in landfills.

- Conservation of resources:Retiring machinery that consumes excessive energy or resources can help conserve natural resources.

Negative Impacts

- Hazardous waste:Machinery may contain hazardous materials that require special disposal procedures.

- Landfill space:Improper disposal of retired machinery can contribute to landfill overcrowding.

- Greenhouse gas emissions:The transportation and disposal of retired machinery can generate greenhouse gas emissions.

Best Practices for Environmentally Responsible Machinery Retirement, Retired a piece of machinery that was purchased on

- Proper disposal:Retire machinery according to environmental regulations and industry best practices.

- Recycle or reuse:Explore options for recycling or reusing retired machinery components.

- Consider energy efficiency:When replacing retired machinery, consider energy-efficient models.

- Reduce waste:Minimize the amount of waste generated during the machinery retirement process.

Legal Considerations

Retiring machinery involves several legal considerations that businesses must be aware of.

Applicable Laws and Regulations

- Environmental laws:Businesses must comply with environmental laws and regulations related to the disposal of hazardous materials.

- Occupational safety and health laws:Businesses must ensure that machinery is retired in a safe manner.

- Tax laws:Businesses may be eligible for tax deductions for the cost of retiring machinery.

- Contractual obligations:Businesses may have contractual obligations related to the disposal or resale of retired machinery.

Importance of Compliance

Complying with legal requirements related to machinery retirement is essential for businesses to avoid legal penalties and protect their reputation.

- Avoid fines and penalties:Non-compliance with environmental or safety regulations can result in fines or penalties.

- Protect reputation:Responsible machinery retirement practices can enhance a business’s reputation as a responsible corporate citizen.

- Maintain relationships:Complying with contractual obligations helps businesses maintain positive relationships with customers and suppliers.

Expert Answers: Retired A Piece Of Machinery That Was Purchased On

What are the key reasons for retiring machinery?

Obsolescence, high maintenance costs, safety concerns, and technological advancements are common reasons for retiring machinery.

How does the purchase date affect machinery retirement decisions?

The purchase date determines the depreciation schedule and useful life of machinery, which influences the timing of retirement.

What are the financial implications of retiring machinery?

Retirement costs include disposal expenses, potential tax implications, and the cost of replacing the machinery.